[ad_1]

Happy holidays, my friends. In the spirit of the season, I’ll try not to be too negative. No asking questions like, What really happened to Lindsey Graham? Or, did Zoom kill the snow day? Or “If Texas does secede from the union, can we keep Austin?” So let’s get started. This week in On the Street, we’ll have a look at all that “bullishness” on Wall Street (or something else that starts with a “B”), the greening of big business and a holiday song from the Chuck Berry archives. But first, the latest on the Republicanized COVID-19 relief package:

Drew Angerer/Getty Images/Getty

Fingers Crossed: As I write this very early Sunday morning, there’s a reported compromise over the $900 billion COVID relief package—all this despite Senate Leader Mitch McConnell’s pulling-the-football-from-Charlie Brown act. For some reason, Republicans, at the last minute, demanded the bill limit the powers of the Federal Reserveto deal with an economic crisis in the future. You know, like a deep recession during a pandemic. (Read here for the latest.) So here’s what it looks like now: the legislation, if passed, will provide, among other things, money for vaccine distribution, food assistance, aid for small businesses, enhanced unemployment benefits of $300 a week and a $600 one-time payout for many of us. And not a moment too soon. Another 935,000 Americans, for example, signed up for first-time, standard unemployment benefits last week. And for many, those benefits are running out. The bill, of course, ain’t perfect. Before the little Federal Reserve trick, there was push back from the likes of Sen. Bernie Sanders and Rep. Alexandra Ocasio-Cortez who said that Republican negotiators were too Scroogey when it came to helping the less fortunate. (A shock.) But at this point, any assistance is a good thing. The trouble is that this could be the Democrats’ last bite at the apple. Unless, of course, those wacky Republican stock traders, Kelly Loeffler and David Perdue, lose their early January U.S. Senate runoff races in Georgia—and the Democrats take control of Congress. Like I said, fingers crossed.

JOHANNES EISELE/AFP via Getty Images

Didn’t We Warn You? The S&P 500 stock index is, year to date, up almost 15 percent as I write this. (Did a pandemic really happen?) Last week, some of the major brokerage firms released their vaccine-fueled predictions for 2021. JPMorgan Chase sees the S&P 500 going up a crazy 25 percent next year. Goldman Sachs? More than 15 percent. I mean, who knows – right? Diane Harris, former Money magazine editor and Newsweek’s deputy editor-in-chief, kind of knows. Back in February, when the dark clouds were forming, she warned folks not to haphazardly jump out of the market. Her article, How to Stay Sane in a Crazy Market is officially my personal finance bible—and it should be yours. Now that the market is booming, her lessons still hold true. “Calm the hell down and stay the course works when the market is tanking—and it also works when the market is soaring,” says Harris.”When you see those crazy numbers…it feels like you should be doing something when doing nothing is probably the way to go.” If you must, she adds, take a look at rebalancing your portfolio. At this point, because of this year’s results, you may be too heavy on stocks compared with bonds. So, Harris says, you could, for example, “sell enough of your winners and put the proceeds into a nice bond index fund to restore your mix to where it should be.” And, oh: stop watching Mad Money and getting all riled up again.

Photo by Drew Angerer/Getty Images

Climate Change Inc.: Remember when everyone got all hot and bothered about President-elect Biden’s kill-off-all-fracking comment during his October debate with President Trump? Well he may be for eliminating it or just for eliminating new fracking. It really doesn’t matter. When it comes to climate change, just watch what big business is going to do. Maybe fossil fuels will dominate in Texas once the state—or the Texas Republican Party— withdraws from the Union. But elsewhere, change is in the air. As you know, GM chief executive Mary Barra last month abandoned the Trump administration’s suit against the state of California. The Golden State had the gall to insist on stronger emission standards. Instead, Barra doubled down on GM’s plans to produce more electric vehicles. If you have been watching pro football, Ford has been running commercials touting electric vehicles. Even Exxon has found religion—or has been shamed into it. Last week its CEO Darren Woods said the company would reduce its greenhouse gas emissions by as much as 20 percent in 2025 compared with 2016. Not as generous as some European oil companies, but a start. Exxon was under tremendous pressure by its investors to do something. Last spring, BlackRock, Exxon’s second-largest shareholder, backed a resolution to split the chairman and CEO roles. The big investing firm, and others, said the combined job was a speed bump that impeded any action on climate change. Meanwhile, investors like New York State’s pension fund—and its $226 billion in assets— are abandoning fossil fuel stocks. In other words: dealing with reality. As Biden’s climate czar John Kerry said on NPR: “Real business people understand this (is) an imperative…They understand changes are coming.”

reuters

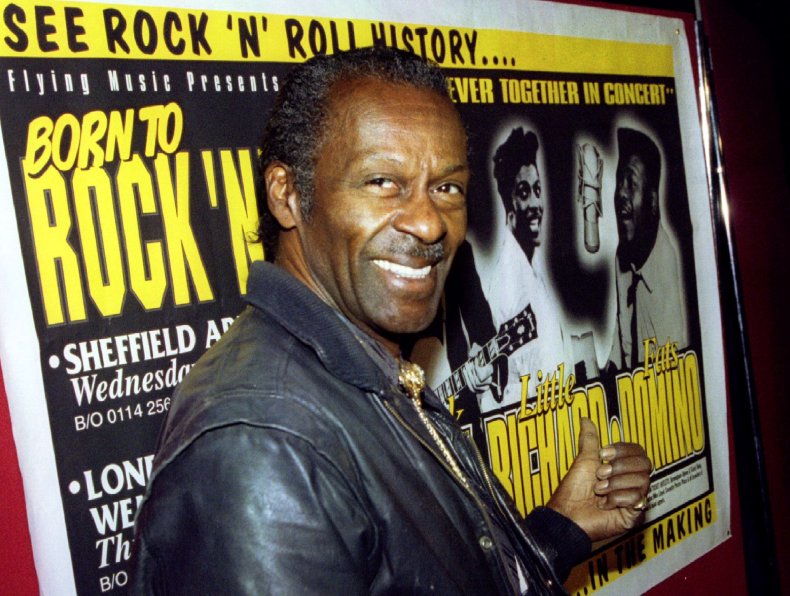

Loose Change: I was just thinking about all those folks who said they’d move to Canada if President Trump won again. They were onto something. Check out this great climate change piece by Abrahm Lustgarten, brought to you by Propublica and The New York Times. The conceit: how Russia—and northern countries such as Canada and Sweden—will eventually dominate agricultural production, thanks to gradually warming, and extended, planting seasons…Taking From the Poor and Giving to the Rich? Not a great week for the trendy brokerage Robinhood, a favorite among young day traders. As reported in Business Insider, the firm agreed to hand over $65 million to the Securities and Exchange Commission. Among other things, the SEC said Robinhood misled customers over the “true costs” of its trades. Also: Massachusetts regulators complained that Robinhood was taking advantage of its young, inexperienced customers. “The (firm’s) platform is not presented as serious investing with substantial risk…It’s presented as some sort of game that you might be able to win,” William Galvin, Secretary of the Commonwealth of Massachusetts, told The Wall Street Journal…Coolest Headline of the Week: Courtesy of The Daily Beast, “Swedish King: Our Wingnut-Approved COVID Strategy Was Deadly.” Unfortunately, it is true…On the Street Juke Box: Well, one more holiday song for you. This one courtesy of Peter Carbonara, one of Newsweek’s musicologists: Chuck Berry and “Run Rudolph Run“…Merry Christmas.

[ad_2]

Source link