[ad_1]

The second coronavirus relief bill has stirred up a whirlwind of controversy and critique. The bill was signed by President Donald Trump on December 27 after it was passed by Congress on December 21. Members of Congress had only hours to sift through 5,593 pages before voting on the bill.

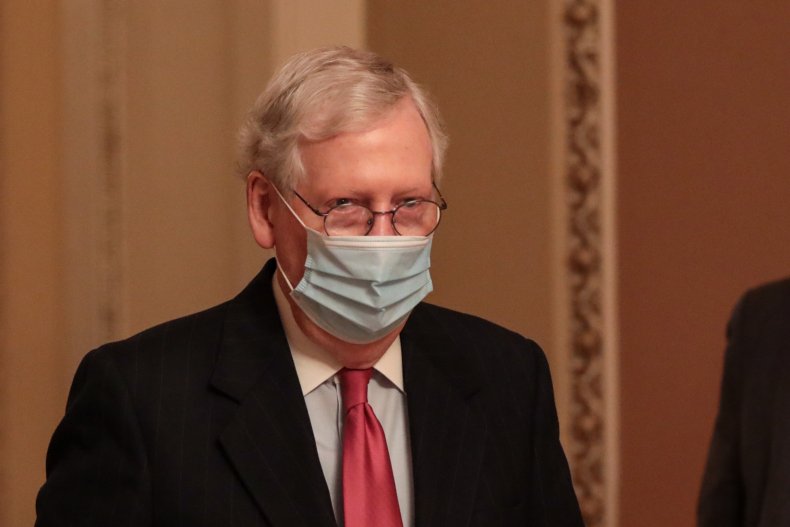

Americans have condemned the $600 individual stimulus checks while Democrats, Trump and even some Republicans have called for $2,000 checks. Senate Majority Leader Mitch McConnell blocked a vote on a standalone bill for the increased payments on December 30, and now it seems he also might have prevented the extension of mandatory paid sick leave.

The $100 billion coronavirus aid package that was passed in March included mandatory paid leave, according to CNBC.

According to the Department of Labor, the Families First Coronavirus Response Act (FFCRA) made it mandatory for employers to provide employees with two weeks of paid sick leave at the person’s regular rate if they had to quarantine, two weeks of paid sick leave at two-thirds of the employee’s regular rate of pay if they need to care for a relative, and up to 10 additional weeks of paid expanded family and medical leave at two-thirds of the regular rate of pay for people who have been employed for at least 30 calendar days and need to take care of a child whose school or daycare was closed because of COVID-19.

The Claim

Complaints are raging on Twitter over the removal of mandatory paid sick leave from the new relief bill.

American author Don Winslow produced a video that he included in a post, which has been retweeted more than 15,000 times as of the morning of December 30.

Cleavon Gilman, an emergency room physician and Iraq war veteran, shared Winslow’s video, claiming that without mandatory paid sick leave, “there’s no incentive to protect employees.”

The Facts

The Internal Revenue Service (IRS) states that FFCRA provided “small and midsize employers refundable tax credits that reimburse them, dollar-for-dollar, for the cost of providing paid sick and family leave wages to their employees for leave related to COVID-19.” The FFCRA provided businesses that had fewer than 500 employees with funds to provide paid sick leave for issues related to the coronavirus. For big businesses with more than 500 employees, paid sick leave was not mandatory, as was the case for small companies with fewer than 50 employees.

Buzzfeed reported that it is now optional, not mandatory, for any employers, regardless of the size of the companies, to provide coronavirus-related paid sick leave to employees. Employers still can provide paid sick leave until the end of March and will receive a refundable tax credit that “fully subsidizes the cost to businesses of paying out sick leave.”

Buzzfeed also reported that McConnell had tried to block mandatory coronavirus-related paid sick leave and that House Speaker Nancy Pelosi originally opposed its removal but conceded in exchange for extending the tax credit. CNBC echoed Buzzfeed’s findings, reporting that McConnell blocked FFCRA from the latest relief package.

According to Business Insider, two bills were passed in the House in May and October to expand mandatory paid sick leave but didn’t make it to the Senate floor. The relief package that McConnell introduced in July also didn’t pass because it left out the paid leave mandate. Now, if employers voluntarily decide to provide paid leave, they will be eligible to receive a portion of the $1.8 billion refundable tax credit.

Newsweek reached out to McConnell and Pelosi, in addition to several other members of Congress, for comment.

The Center for Economic and Policy Research (CEPR) found that out of 22 wealthy nations, the United States is the only one that does not guarantee workers some form of paid sick leave. According to CEPR, the United States also is the only country that “does not provide paid sick leave for a worker undergoing a 50-day cancer treatment.”

The Ruling

True.

McConnell did block the extension of coronavirus-related mandatory paid sick leave, but Pelosi approved it in exchange for extending the tax credit.

Businesses still have the option to provide paid sick leave, and their tax credit incentive has been extended until the end of March, but millions of Americans who need to quarantine, take care of a relative or take care of their children are not guaranteed a form of paid leave.

Cheriss May/Getty Images

[ad_2]

Source link