[ad_1]

For China, the geoeconomic coverage rules behind the Iron Silk Road rail hyperlink via Central Asia had been to offer China a hedge in opposition to its reliance on Pacific Ocean economies within the occasion of commerce tensions. However, 2020 demonstrated that the Central Asian states haven’t any hedge in opposition to the geoeconomic threat of counting on China as a commerce accomplice. On the China-Kazakhstan border, rail freight wagons and vehicles have been backed up for over a month as China tightens import restrictions, leaving Kazakh items destined for China sitting idle.

Rail freight backed up on the Dostyk and Altynkol border crossings reportedly totals greater than 7,000 wagons, a few of which have been ready for as much as 42 days. Freight delays began in October, with agricultural exporters hit hardest, as grain and oilseed merchandise can spoil if not delivered on time. Freight forwarders are additionally uncovered to losses as they worry fines from their Chinese-side consumers for failure to ship, resulting in requires the Kazakhstan Ministry of Industry and Infrastructure Development to subject power majeure notices for Kazakh exporters.

In 2016, a Strategic Cooperation Agreement and a Freight Forwarding Services Agreement had been signed between the Kazakhstan nationwide railway state-owned enterprise KTZ (Kazakhstan Temir Zholy) and the Urumqi Railway Bureau, now the China Railway Urumqi Group. The agreements permit for the passage of 18 trains per day. This was adopted the yr after with a KTZ and Russian Railways Strategic Cooperation Agreement. But it’s the China aspect that’s forcing the current slowdown by proscribing imports into China below the guise of pandemic quarantine controls.

Changes between Kazakhstan-China cross-border commerce as a direct results of the 2020 pandemic included suspension of non-scheduled CR-Express China-Europe rail freight, however not a discount within the complete variety of cross-border trains. This had little impact on the China-Europe container trains, because the overwhelming majority of those prepare crossings are scheduled, however did present an institutional grounds on which to limit Kazakhstan’s exports to China.

Kazakhstan’s unilateral commerce restrictions imposed because of the pandemic included unilateral bans on exports of most wheat and processed wheat and rye merchandise, buckwheat, sugar, potatoes, and sunflower seeds and oil. The Eurasian Economic Union additionally imposed export restrictions on an analogous array of cereal grains and fundamental meals together with crushed and uncrushed soybeans, a strategic import for China.

But since July 1, Kazakhstan has been reopening its border crossings, with out reciprocation from the Chinese aspect. In addition to Altynkol (Khorgos) and Dostyk (Alashankou), Kazakhstan has reopened the minor street border crossings of Kalzhat and Maikapshagai, however the border stations on the China aspect stay closed. In October, Kazakh railway wagons started backing up on the border, however new China pandemic restrictions since November 15 additional diminished rail visitors to a most of 10-11 trains per day, with lows of six to seven per day. Zhanibek Tayzhanov, deputy chairman of the transport committee of Kazakhstan’s Ministry of Industry and Infrastructure Development requested China to reinstate the 18 trains per day benchmark however as a substitute an settlement in late December solely elevated the day by day restrict to 15-16 trains. The most important bottleneck is on non-containerized freight wagons, largely acutely affecting agricultural commodities.

This means the freight backlog will start to ease however will stay an issue. Kursiv studies Kanat Kobesov, deputy basic director of KTZ-Freight Transportation LLP saying that the backlog of rail wagons fell from 9,000 to 7,000 via December, with the Kazakh aspect prioritizing perishable agricultural commodities and items. The Kazakh grain exporter Food Contract Corporation reportedly despatched 438 rail wagons to the border in October, with solely 60 wagons crossing by December. Shokan Badykhan, govt director of the Grain Union of Kazakhstan, has stated the issue is predicted to proceed all through the primary quarter of 2021.

Such a bottleneck on the border naturally creates a backlog farther down the logistics chain, Kursiv reported Yevgeny Karabanov, founding father of the Severnoye Zerno Group, as telling a public on-line discussion board for representatives of the National Chamber of Entrepreneurs of Kazakhstan (Atameken) on December 22 that his firm had 17 rail wagons certain for Dostyk sitting idle at Nur-Sultan or Akkol.

Trucks making an attempt to cross on the Nur Zholy/Khorgos street crossing have additionally confronted delays. Where beforehand 100-150 vehicles had been passing per day, the China aspect of the checkpoint is now solely accepting 20-30 per day. The backlog of truck drivers sleeping of their automobiles has resulted in intervention by the Kazakh central authorities in opposition to extortion of truck drivers by native customs authorities. Kazakhstan’s new contactless digital queue system for Nur Zholy has additionally added to the issue, amid widespread allegations from freight haulers of corruption, as some within the queue are seemingly bypassing others.

Number of in- and outbound rail wagons 2019-2020, China.

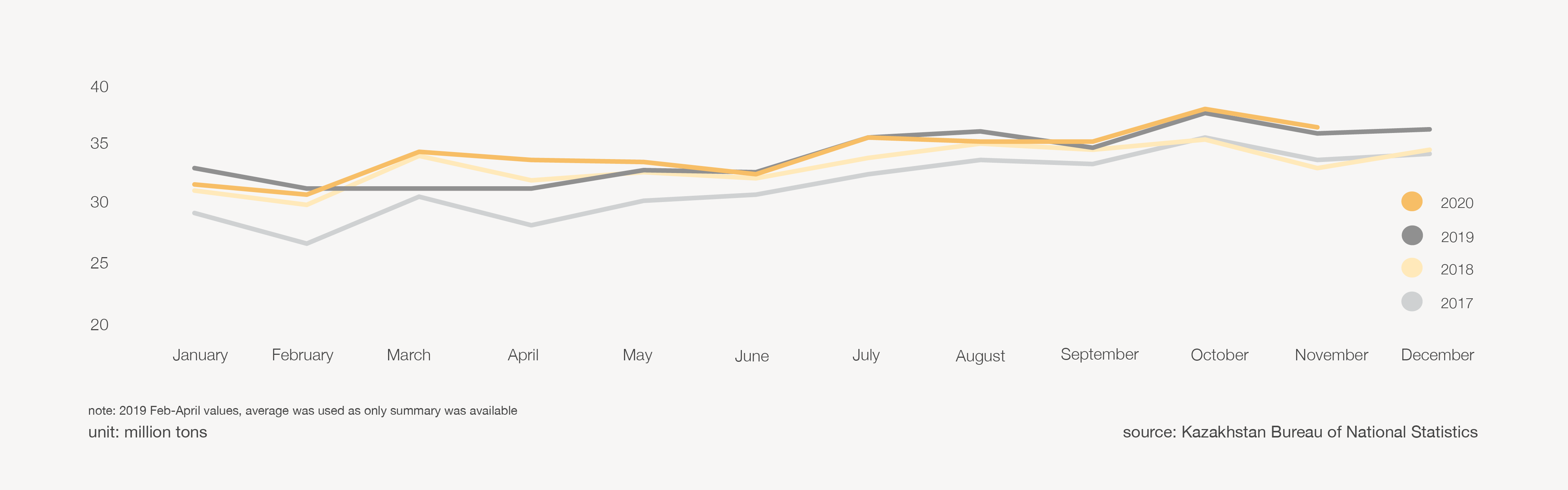

Monthly knowledge on all items transported by rail 2017-2020 in million tons, Kazakhstan.

Cross-border statistics for 2020 don’t help China’s declare that the brand new restrictions are because of the pandemic. While all different types of China commerce transport fell in 2020 because of the pandemic, rail remained largely regular all year long. Over the previous decade, the month-to-month common rail commerce between Kazakhstan and China measured in million of tons moved from across the low 20s in 2008-2011 to the mid 30s in 2017-2020, with no vital discount in 2020 because of both the pandemic or any political subject, till now. Monthly customs knowledge underlines the impression of the coverage that China has applied on rail imports: in November 2020, 16.7 % fewer rail wagons crossed all of China borders than the identical month in 2019.

For Kazakhstan to subject power majeure notices can be to just accept that COVID-19 is genuinely disrupting provide chains. Trade and transport knowledge from each China and Kazakhstan present that this freight connection must be functioning usually. Statistics present no main adjustments in rail freight transport between Kazakhstan and China via the pandemic yr. This implies that China’s actions are extra simply analyzable as a traditional non-tariff barrier to commerce drawback. Without central political malice, this looks as if subnational bureaucratic incompetence on the a part of China.

The National Chamber of Entrepreneurs of Kazakhstan (Atameken) has been probably the most vocal in calling for presidency motion to resolve the freight bottlenecks. A coalition of freight forwarders and exporters joined the Transport Committee of the Ministry of Industry and Infrastructure Development on a December 24 journey to the Dosytk/Alashankou border crossing station. The state-market discipline journey included Atameken, KTZ and different logistics corporations, the Kazlogistics Union of Transport Workers, and the Grain Union of Kazakhstan.

In mid-December, Kazakhstan’s Ministry of Foreign Affairs despatched a observe to the Chinese Embassy in Nur-Sultan in regards to the border subject. And a weekly subnational inter-governmental dialogue on rail freight every Tuesday stays in place. Kazakh Minister of Trade and Integration Bakhyt Sultanov stated that China now has an analogous issues with its different land border buying and selling companions, together with with Kyrgyzstan, Russia, and Mongolia. However Sultanov additionally stated that the scenario highlights the risks of trade-reliance on China. Kazakh Prime Minister Askar Mamin, who was president of KTZ from 2008 till 2016, is presently in negotiations with the Chinese aspect to resolve the problem.

These China import bottlenecks name into query the viability of a few of the wider elements of Belt and Road Eurasian transport hall integration, notably the Middle Corridor connection to Turkey. From July 2020, a daily service between Xi’an China and Turkey utilizing the Middle Corridor and Baku-Tbilisi-Kars rail infrastructure was formalized. The grander visions of Iran, Turkey, and Pakistan being linked by rail to China appear relatively distant if the easier bilateral Kazakhstan-China freight system is bottlenecking.

For Belt and Road economies which envisioned the shifting of the regional commerce paradigm from land-locked to “land-connected” or “land-linked,” this bottleneck demonstrates that China isn’t any extra dependable a commerce accomplice than Russia. Without any coverage communication or political rationalization, Kazakhstan’s exporters and freight forwarders are below strain because of the actions of the Chinese state. For the European Union economies linked to the Iron Silk Road, the scenario once more demonstrates the shortage of transparency in settlement paperwork and customs statistics. The Kazakhstan-China intercontinental rail system has taken on the institutional types of the governance fashions of the states that run it.

Tristan Kenderdine is analysis director at Future Risk; Péter Bucsky is Ph.D. candidate on the University of Pécs, Doctoral School of Earth Sciences.

[ad_2]

Source link