[ad_1]

Study shows more than 70% of consumers prefer cashless payment options for a major part of their monthly spending

Abu Dhabi-based innovative fintech enterprise PayBy has released its first study of the UAE consumer payments landscape, conducted in association with Kantar. The study included a diverse sampling of UAE consumers to evaluate their attitudes to spending, saving and modes of payment in light of the coronavirus pandemic.

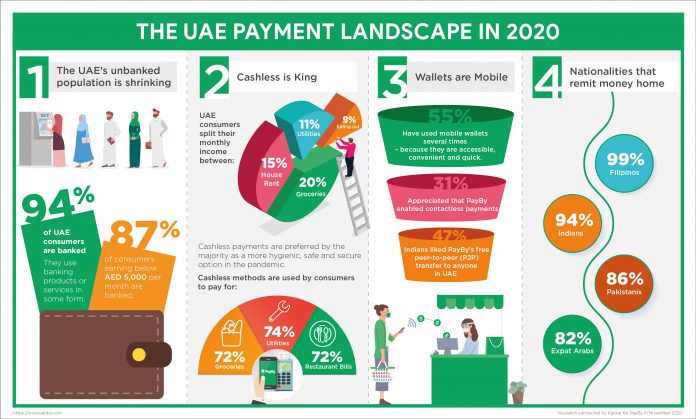

The PayBy study revealed that the numbers of the unbanked – those with no access to a bank account – have shrunk in the UAE. An overwhelming majority of the respondents (94%) use banking products or services in some form. This is slightly reduced to 87% among lower income groups and those earning below AED 5,000 per month.

According to the PayBy study, the majority of consumers have pivoted to cashless payments as a more hygienic, safe and secure option in the pandemic environment.

Across cohorts, the major spends of monthly income were on groceries (20%), house rent (15%), utilities (11%) and eating out (9%). The PayBy study found that cashless methods were by far the preferred option to pay for these major expenses: 72% of respondents used cashless methods to pay for groceries, 74% for utilities and 72% for eating out. Housing, however, was a notable exception, with more than half of respondents (55%) paying their rent in cash.

Awareness and familiarity with mobile wallets was high across different groups of respondents. In fact, more than half (55%) have used mobile wallets several times. Consumers cited the ease of access, convenience and quick transfer as key reasons for using mobile wallets.

The study also evaluated respondents’ feedback on the PayBy app. The response was overwhelming positive (98%). While nearly one third of the respondents (31%) appreciated that it enabled contactless payments, another key reason for liking PayBy was the free peer to peer (P2P) transfer to anyone in UAE – with nearly half of Indian respondents (47%) liking this aspect the most. Among higher income groups, P2P transfers were almost as appreciated as the microcredit facility (from AED 500 to AED 5000) offered by PayBy.

While the UAE moves towards becoming a cashless society and increased financial inclusion, two key reasons are responsible for the stubborn pockets of cash usage that still remain. Half the respondents in the PayBy study said they always carry cash on them. Paying in cash also allowed respondents to negotiate better discounts.

The PayBy study also highlights how the COVID-19 pandemic has irreversibly altered the payment landscape in the Middle East. Cash payments have migrated to payments by cards and mobile wallets. To survive in the new normal, businesses of all scales will have no option but to swiftly digitalize, in response to consumer demands.

[ad_2]

Source link