[ad_1]

WASHINGTON — The COVID-19 vaccines are slowly working their way into the U.S. population, promising to tamp down the health ravages of the pandemic. But even after that massive logistical task is complete, economic challenges and changes created by the virus look like they could linger for a long time.

Apart from the doctor appointments and ICU beds, the data show a string of flashing yellow caution lights marking the road to an economic recovery, from unemployment rates to retirement savings.

Let’s start with the number that has dominated the economic discussion around COVID: the unemployment rate. Much has been made of the resilience of the U.S. economy over the last year and its bounce back after the crash of last spring has been impressive.

Starting at 3.5 percent in February of 2020, the unemployment rate jumped to 14.8 percent in April before closing the year at 6.7 percent in December. The current unemployment rate is still higher than it was when the pandemic began. In fact, the last time the national number was this high was early 2014. But in context, the figure is still way down from where it was when the economy shut down in April, making it feel like a positive story.

Look under the surface, however, and there are a lot of concerns in the data that could have long-term effects.

A survey from Kiplinger’s Personal Finance and Personal Capital released in January found that a third of Americans withdrew or borrowed money from their retirement accounts in 2020. The reason from most of those withdrawals? Simply making ends meet.

And about two-thirds of those redirected retirement money was used for “living expenses.” In essence, those numbers mean that in 2020 people were pulling money out of their future to pay for their daily lives.

Those are the kinds of choices that change how people live or plan to live in the months and years ahead. They can change spending plans and retirement plans and college enrollment plans. It may take years to see what the real impacts are going to be, but there will be consequences.

On top of that, those relatively rosy unemployment numbers are not as clear as they seem to be at first blush. Your personal situation can depend greatly on your race.

That 6.7 percent number isn’t bad, but the unemployment rate was 9.9 percent for African Americans in December. For Hispanics it was 9.3 percent. Those figures are large enough to create high levels or hardship particularly in places with large minority populations. They likely mean employers have permanently shuttered in a lot of communities.

Education also plays big role in your COVID employment circumstance. For those whose highest level of educational attainment is a high school diploma, the December unemployment rate was 7.8 percent. For those a college degree the figure was only 3.8 percent.

And even before you break down that 6.7 percent unemployment rate into demographic groups, there is reason to believe the figure is too low and is missing a lot of people who would like to be working.

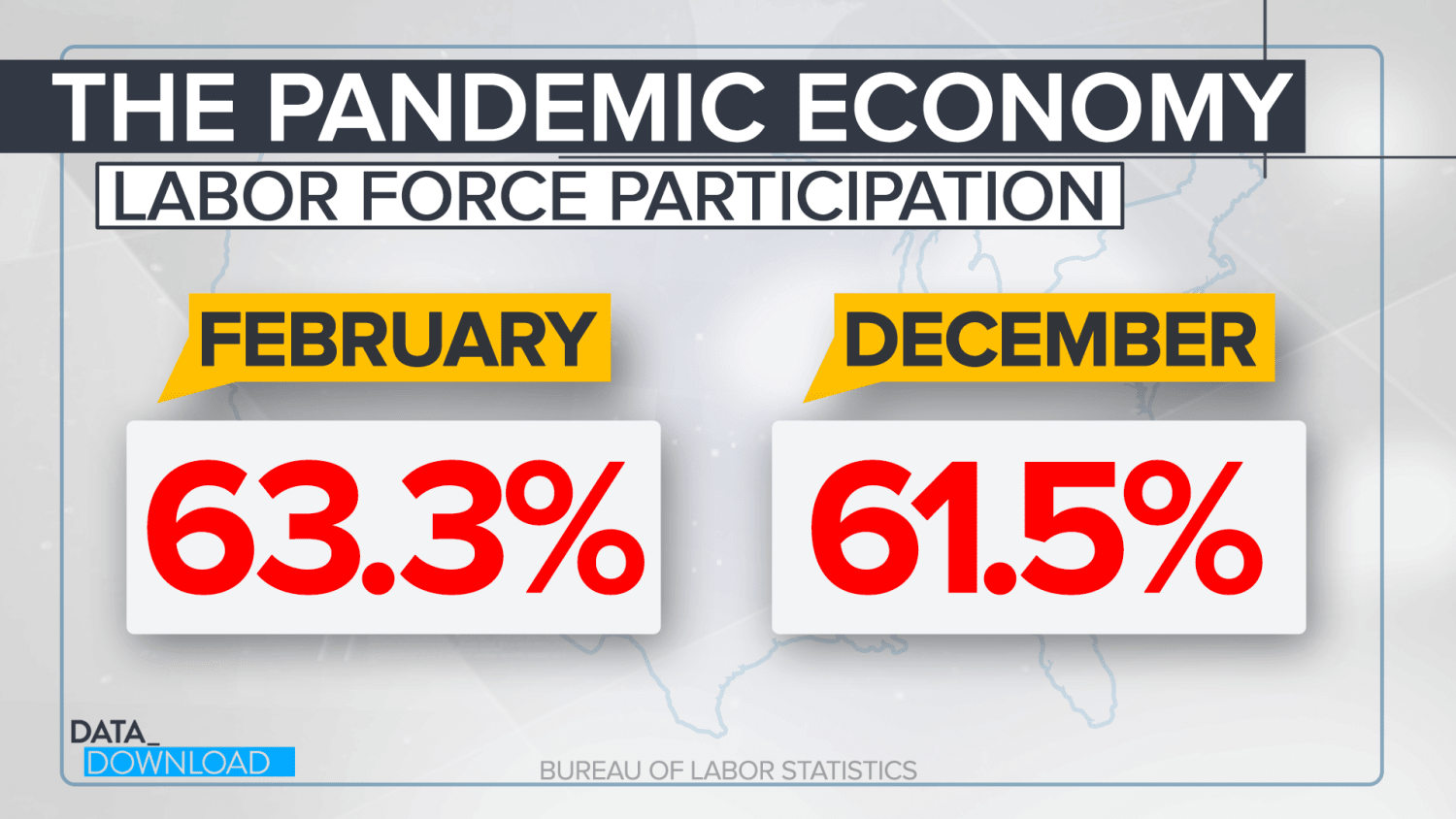

Since the pandemic began, the number of Americans in the national labor force —that is people actually looking for job — has declined, according to the Bureau of Labor Statistics.

That decline from 63.3 percent (in February) to 61.5 percent (in December) of the working age population “participating” in the labor force probably doesn’t not sound like much of a change. But that 61.5 percent figure is the lowest the labor force participation number has been since the mid 1970s, when women were still entering the workforce.

In real terms it means that there were 4 million fewer people in labor force in December than there were in February. Four million people, that’s roughly the population of Los Angeles.

Some of those who’ve opted out are probably mothers and fathers who want or need to stay home with school-age children, but others are certainly not in that group. And when the virus is eventually tamed, former workers of many stripes will likely re-enter a labor force and an economy that has been restructured by the pandemic — one with fewer brick-and-mortar retailers, a shrunken hospitality industry and other remade sectors.

No one knows for certain what the post-COVID economy will look like, how many changes were temporary and how many were structural. But regardless of what’s behind the changes, there will be an adjustment period, possibly a lengthy one.

Add it all up and the quest to vaccinate Americans is not just about putting an end to the COVID saga in the United States, it’s just a step — albeit a crucial one — on a what appears to be a long path ahead.

[ad_2]

Source link