[ad_1]

In brief: China wants to become a dominant force in technology, but in the process they may have taken a few shortcuts, which explains why it’s locked into a costly trade war with the United States. Semiconductors are among the biggest pain points however, which is why the country is investing $155 billion into research and development of advanced chip making technologies.

As the trade war between China and the US rages on, the Chinese government is doing everything in its power to prop up the local tech industry. Flagship chinese companies like Huawei no longer get access to American silicon or the software required for their products.

As of writing, China is capable of covering over 20 percent of the chips needed in the local industry, but the Chinese government plans to increase that number to 70 percent by 2025.

This is part of the country’s famous “3-5-2” policy to replace all foreign hardware and software from its public infrastructure with homegrown solutions, which will inevitably impact some American tech giants such as Dell, HP, and Microsoft.

China is pouring exorbitant sums of money into local tech companies hoping to close the technology gap as soon as possible. In 2019 alone, the government approved $29 billion in subsidies for companies like Zhaoxin, Huawei, and SMIC.

Zhaoxin is currently developing x86 processors, while Huawei is working on Arm-based CPUs, as well as GPUs and AI accelerator cards. SMIC is by far the most important piece of the puzzle, as evidenced by last year’s $7.6 billion share sale. It is, after all, the country’s largest foundry, and key to reducing China’s reliance on imported chips.

This will be a monumental task, as the country’s appetite for silicon has been growing quickly, reaching 543 billion units worth $350 billion in 2020. This is why China is investing no less than $155 billion through 2025 in bolstering its local semiconductor manufacturing capacity over the next five years. And that’s just one slice of the estimated $1.4 trillion budget that President Xi Jinping has pledged for China’s digital transformation journey in the coming years.

Last year, the Trump administration tightened the screws on SMIC’s ability to trade with photolithography equipment manufacturers that produce advanced EUV machines. As a result, China is now buying almost all of the used machines from countries like Japan for $1 million apiece even though they’ve been rendered obsolete by much more advanced equipment. At the same time, it’s also purchasing $1.2 billion worth of old, deep ultraviolet lithography (DUV) equipment from Dutch manufacturer ASML.

The idea is to use this older equipment to make chips for automotive, industrial and military applications, where process nodes like 14 nm and 28 nm are mature and perfectly adequate for these applications.

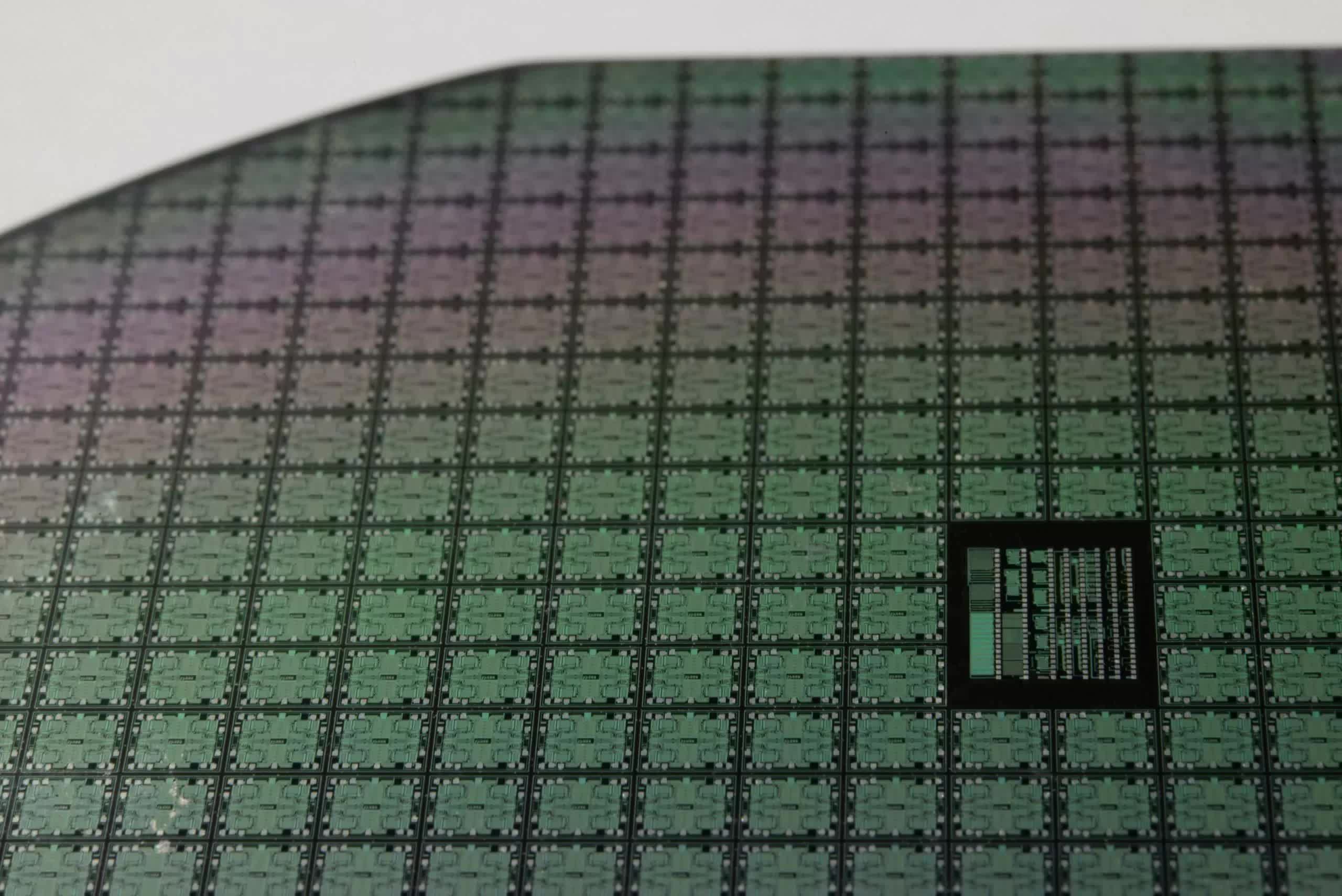

In the meantime, SMIC is working to build more 300 mm wafer manufacturing plants and catch up with TSMC and Samsung on more advanced process nodes. It’s a bold plan, and one that will undoubtedly take a decade to unfold and which will be peppered with failures along the way. It is, however, easier than trying to change how the Internet works, which is going nowhere fast.

[ad_2]

Source link