[ad_1]

In February, Nigerian fintech startup Mono announced its acceptance into Y Combinator and, at the time, it wanted to build the Plaid for Africa. Three months later, the startup has a different mission: to power the internet economy in Africa and has closed $2 million in seed investment towards that goal.

The investment comes nine months after the company raised $500,000 in pre-seed last September and two months after receiving $125,000 from YC. Mono’s total investment moves up to $2.625 million, and investors in this new round include Entrée Capital (one of the investors in Kuda’s seed round), Kuda co-founder and CEO Babs Ogundeyi; Gbenga Oyebode, partner at TCVP; and Eric Idiahi, co-founder and partner at Verod Capital. New York but Africa-based VC Lateral Capital also invested after taking part in Mono’s pre-seed.

In a region where more than half of the population is either unbanked or underbanked, open finance players like Mono are trying to improve financial inclusion and connectivity on the continent. Open finance thrives on the notion that access to a financial ecosystem via open APIs and new routes to move money, access financial information and make borrowing decisions reduces the barriers and costs of entry for the underbanked.

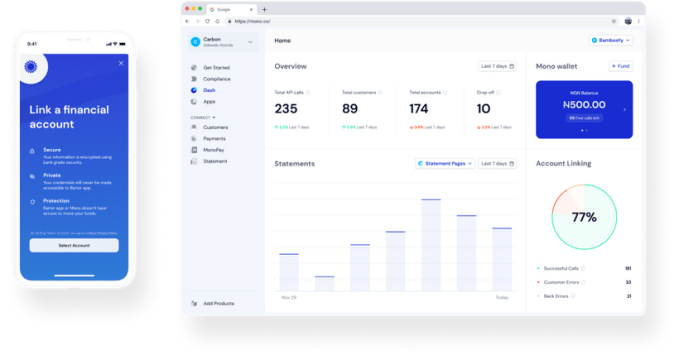

Launched in August 2020, the company streamlines various financial data in a single API for companies and third-party developers. Mono allows them to retrieve information like account statements, real-time balance, historical transactions, income, expense and account owner identification with users’ consent.

When we covered the company early in the year, it had already secured partnerships with more than 16 financial institutions in Nigeria. In addition to having a little over a hundred businesses like Carbon, Aella Credit, Credpal, Renmoney, Autochek, and Inflow Finance access customers bank account for bank statements, identity data, and balances, Mono has also connected over 100,000 financial accounts for its partners and analysed over 66 million financial transactions so far.

Mono has done impressively well in a short period. While it appears to have figured out product-market fit, CEO Abdul Hassan is quick to remind everyone that the burgeoning API fintech space is just an entry point to its pursuit of being a data company — a case he also made in February.

“The way I see it, our market is not that big. Compare the payments market now with 2016, when Paystack and Flutterwave just started. The payments space in 2016 was very small and the number of people using cards online was very small,” said Hassan, who co-founded the company with Prakhar Singh. “It’s the same thing for us right now. That’s why our focus isn’t only on open banking but data. We’re thinking of how we can power the internet economy with data that isn’t necessarily financial data. For instance, think about open data for telcos. Imagine where you can move your data from one telco to another instead of getting a new SIM card and making a fresh registration. That’s where I see the market going, at least for us at Mono.”

Abdul Hassan (CEO) and Prakhar Singh (CTO)

He adds that the company is taking an approach of building a product one step at a time until it can fully diversify from financial data offerings, including connecting with payment gateways (Paystack and Flutterwave) and other fintechs like wealth management startups Piggyvest and Cowrywise.

“When you’re able to connect to all the systems, a lot of use cases will come up. The first step is how can we connect to all available data and open it up for businesses and developers,” he continued.

Therefore, Mono will use the funding to reinforce its current financial and identity data offerings and launch new products for diverse business verticals. Also, a long-overdue pan-African expansion to Ghana and Kenya is top priority. The last time I spoke with Hassan, the end of Q1 looked feasible to get into at least one of the two markets but it didn’t turn out that way. But the wait seems to be over as the company said it’d be going live in Ghana next month with a handful of existing customers from Nigeria and new ones in Ghana. Some of these partners include five banks (GTBank, Fidelity Bank and three unannounced banks) and the mobile money service arm of MTN Ghana.

“Our expansion is mostly inspired by our customers looking to expand to other markets, same with some of our products. We work with our customers to give them the right tools to build new experiences for their customers,” Hassan stated.

Image Credits: Mono

Mono is one of the three API fintech companies to have raised a seed investment this year. Last month, another Nigerian fintech Okra closed $3.5 million while Stitch, a South African API fintech, launched with $4 million in February. Back to back investments like this show that investors are incredibly optimistic about the market. Avil Eyal, managing partner and co-founder of Entrée Capital, one of such investors, had this to say.

“We are very excited to be working with Abdul, Prakhar and the entire Mono team as they continue to build out the rails for African banking to enable the delivery of financial services to hundreds of millions of people across the African continent.”

[ad_2]

Source link