[ad_1]

It’s no surprise the wealthiest Americans get a passdiscredited theory that if we give more tax breaks to rich people, they will generously dole out more to the rest of us, and the country will be more prosperous.

That has been the trend since President Ronald Reagan’s “supply-side economics,” aka “trickle-down” economics, dropped the nominal tax rate to 28%.

In 2017, Donald Trump brought it down even lower to a whopping 21%.

But thanks to legislation carving out generous loopholes, those who should be paying even that 21 percent are getting away without having to part with a single cent.

The past 20 years, CEOs have boasted an average increase 350 times more than their employees.

According to a recent Treasury Department watchdog report, the IRS failed to collect more than $38.5 billion from taxpayers earning over $200,000 a year, and more than $2.4 billion from those with incomes over $1.5 million.

The pandemic has only exacerbated it.

According to last year’s Americans for Tax Fairness and the Institute for Policy Studies analysis, American billionaires’ wealth grew an average of $42 billion each week the COVID-19 pandemic bared down on us, more than $700 billion total since March 18, 2020, the date the analysis indicates as the first official day of the pandemic emergency.

The 651 richest billionaires’ total wealth increased more than $1 trillion during the pandemic.

Now we have another report, from ProPublica, revealing leaked IRS tax filings that show between 2014 and 2018, the wealthiest 25 Americans enjoyed a $400 billion windfall while paying equivalent to a 3.4% tax rate.

Jeff Ernsthausen, a senior data reporter at ProPublica, this week stated during an interview with Democracy Now!:

“Typical wage earners like you or me, we pay taxes every time we get a paycheck. But for the ultra-wealthy, it’s a completely different story.”

Some of that story’s characters include Berkshire-Hathaway billionaire Warren Buffett, who famously bemoaned the fact he pays a lower tax rate than his secretary.

Unless his secretary paid less than 0.1%, that’s true.

As Jeff Ernsthausen explained:

“Warren Buffett is sort of the—one of the best examples of how this works. So, Berkshire Hathaway, somewhat famously, doesn’t pay a dividend. And because of that, Warren Buffett’s income, as a major shareholder of Berkshire, ends up being relatively low every year for someone with as much money as he has. And so, his wealth has, you know, shot up by tens of billions of dollars in the five-year period that we focus on in our story, and he paid in the millions in taxes. And that’s because his company is structured in such a way that he’s not ever really realizing any of those gains in a way that the U.S. tax system recognizes.”

His wealth has exploded $24 billion.

The world’s richest person, Amazon.com founder and CEO Jeff Bezos’, net worth increased nearly $65 billion the past year during the pandemic.

According to the ProPublica report, Bezos paid no federal income taxes in 2007 or 2011.

Jeff Ernsthausen added:

“The example of Jeff Bezos is a good one for illustrating this. So, between 2006 and 2018, his wealth grew by almost $130 billion. During that time, he paid something on the order of $1.4 billion in taxes, which sounds like a lot, but it’s almost at 1% on the amount that his wealth went up. And so, in some years he had a very—you know, had registered very low income, and therefore ended up paying almost nothing in taxes, and in a couple years, nothing in taxes.

Tesla and Space X founder Elon Musk–the world’s second richest person–paid no federal income taxes in 2018.

The richest people in America pay no income taxes.

Warren Buffett 0.10%

Jeff Bezos: 0.98%

Elon Musk: 3.27%Regular Americans are paying 20%+. It’s just extraordinary how rigged the system is. Let’s fix it.

— Chris Murphy (@ChrisMurphyCT) June 8, 2021

George Soros—right-wing hate media‘s favorite “Democrat mega-donor”–paid no federal income tax three years in a row.

Former NYC mayor (and brief Democratic presidential candidate) Michael Bloomberg skipped a year on his taxes.

For 2017, he paid $70.7 million in federal income taxes yet he claimed $1.9 billion in income.

That’s the equivalent of paying a 3.7% tax rate.

Investor Carl Icahn was able to circumvent federal income taxes in 2016 and 2017 by deducting sizable interest payments on his companies’ debts.

When asked about the White House‘s response to the explosive report, press secretary Jen Psaki told the Washington Post:

“There is more to be done to ensure that corporations, individuals who are at the highest income are paying more of their fair share. Hence, it’s in the president’s proposals. His budget and part of how he’s proposing to pay for his ideas will go ahead.”

Yet that did not stop the Biden administration from launching a probe into the source of the leak instead of the laws, policies, and financial regulations permitting the high-tech piracy.

This just affirms the need for a wealth tax like the “Ultra-Millionaire Tax Act” Mass. Sen. Elizabeth Warren introduced earlier this year.

Her bill proposes an annual two-percent tax on households and trusts boasting net worth between $50 million and $1 billion, and a three-percent tax on anything above.

If a Medicare-for-All single-payer national health care plan is enacted, the three-percent above one billion would increase to six percent.

Warren’s bill includes a provision to grant an additional $100 million to the Internal Revenue Service (IRS), require a 30-percent minimum audit rate for those subject to the tax, and create a 40-percent tax on $50 million net worth for people who surrender U.S. citizenship to avoid paying.

Under Warren’s plan, Jeff Bezos would owe $5.7 billion.

Elon Musk would owe $4.6 billion and still have over $148 billion at the end of the year.

Bill Gates would have to pay $3.6 billion.

Facebook CEO Mark Zuckerberg, $3 billion.

In 2018, the Internal Revenue Service (IRS) collected $3.5 trillion in taxes, almost 95 percent of total federal revenues.

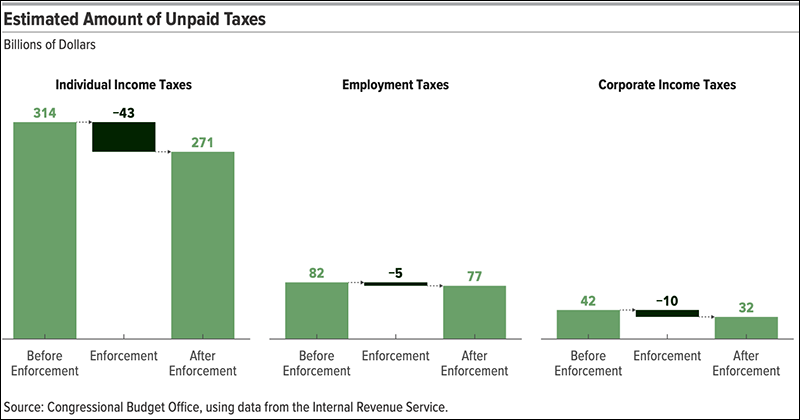

But there is also an amount taxpayers do not pay by the filing deadline, called the tax gap, the IRS estimates between 2011 and 2013 to be, on average, $441 billion annually.

Recent Harvard University research shows those responsible for 70 percent of that tax gap are the richest one percent of income earners.

That means the wealthiest Americans–the ones many assume are paying the most taxes since they should–are gypping the American public out of about $266 billion.

Image credit: Congressional Budget Office via TMI

Vt. Sen. Bernie Sanders explained:

“With the money that these tax cheats owe, this year alone, we could fund tuition-free college for all, eliminate child hunger, ensure clean drinking water for every American household, build half a million affordable housing units, provide masks to all, produce the protective gear and medical supplies our health workers need to combat this pandemic, and fully fund the U.S. Postal Service. That is an absolute outrage, and this report should make us take a long, hard look at what our national priorities are all about.”

The rich will still be rich.

Except, under progressive taxation where the rich pay according to their wealth, they won’t be rich in an increasingly poor country.

Ted Millar is writer and teacher. His work has been featured in myriad literary journals, including Better Than Starbucks, Caesura, Circle Show, Cactus Heart, & Third Wednesday. He is also a contributor to The Left Place blog on Substack, Liberal Nation Rising, and Medium.

[ad_2]

Source link