[ad_1]

Software AG’s first-quarter 2021 results have been released, showing a mixed financial bag as the company pivots toward subscription revenue models.

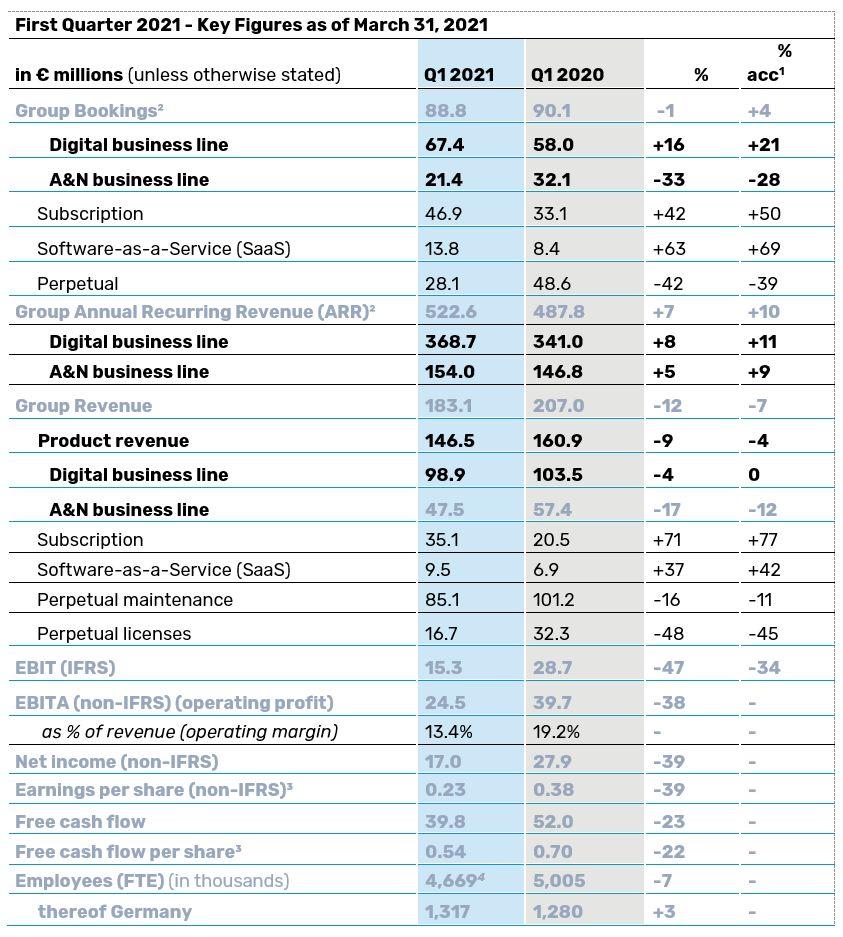

On Friday, the enterprise solutions company published Q1 2021 results (statement), revealing revenues of €183.1 million, down 7% year-over-year with basic earnings per share (EPS) (non-IFRS) of €0.23, a 39% decline in comparison to Q1 2020 EPS of €0.38.

In Q4 2020, Software AG reported €237.8 million in revenue.

Software AG reported an operating profit (EBITA) of €24.5 million, down 38% year-over-year and net income (non-IFRS) of €17 million, a drop from Q1 2020’s €27.9 million. Free cash flow of €39.8 million, a decline of 23% year-over-year, has been recorded.

“The Group’s free cash flow saw continued impact by the technical effect of its transformation program on reported revenue, as well as investments which impact overall profitability,” Software AG said.

The company noted the sale of the Software AG Spanish Professional Services business unit has resulted in a lower cost base over the first quarter of 2021.

The vendor’s Digital Business Platform (DBP), including cloud and IoT, reported revenues of €98.9 million. Group bookings account for €67.4 million, with growth of 21% and annual recurring revenue (ARR) up 11% year-over-year.

Software AG reported 34% growth in subscription bookings and 71% growth in SaaS bookings. However, perpetual contracts declined by 25% in the quarter, an expected downturn as the group shifts to subscription-based revenue models.

A&N revenues reached €47.5 million, together with bookings worth €21.4 million, a decline of 28%.

Overall bookings reached €88.8 million, a growth rate of 4%.

“This year is about doubling down on our strategy and investing for growth,” commented Matthias Heiden, Software AG CFO. “With recurring revenue reaching 89 percent of our product revenue total, we are seeing the investments we’ve made increase the predictability and quality of our revenue stream. We remain focused on balancing our investments with prudent cost control to ensure we deliver on our margin ambitions.”

Previous and related coverage

Have a tip? Get in touch securely via WhatsApp | Signal at +447713 025 499, or over at Keybase: charlie0

[ad_2]

Source link